December 25, 2022

Oil Financial Market

If you choose toapply for a sameday loanthen follow these four steps for applying:( https://www.pensacolavoice.com/mlm-compensation-plans/ )

Compare and shop around different lenders.

Don’t choose the first one you come across.Consider all lenders to locate the best credit for your requirements.Make sure you examine rates and any charges imposed by the lending institution.With credibility, you are able to quickly compare prequalified rates from a variety of lenders in less than two minutes after filling in a single form.

Fill out the form

If youqualify for personal loansthen you’ll have to submit a complete application as well as complete any required documents.Be sure to complete and accurately complete the application and submit the documents promptly to avoid delays.

Accept the loan offer

Review your loan offer thoroughly to ensure there aren’t any surprises later in the future.If you are satisfied with the terms, you can confirm that you have accepted the loan and begin the financing process.

How to get your money

If receiving your funds throughDirect DepositYou’ll need to enter the routing number of your bank as well as your account number.This allows the lender to direct deposit the funds to your bank account.

What do you need to know prior to making a decision to take out a same-day loan?

Before you take out a loan, make certain to research the lender thoroughly and go over the conditions and terms.If you’re unable to meet the necessary repayments, then the loan may not be the best option to meet your financial needs.Be aware that you may be able to take out amodest loanfrom some lenders, and it can be more affordable to pay back over the long term.

It is also common to require evidence with your application like paystubs or the most current tax returns to prove your earnings.

July 3, 2023

Common troubleshooting issues

July 2, 2023

Ventilation requirements

May 22, 2023

Safety regulations

May 13, 2023

Safety regulations

May 9, 2023

Safety regulations

Gas leak detection devices play a crucial role in ensuring the safety of gas appliances, boilers, and stoves. These devices are designed to detect even the smallest leaks of natural gas or propane, alerting users to potential dangers before they escalate into hazardous situations. One example that highlights the importance …

Read More »

March 23, 2023

Energy efficiency

Gas appliances, boilers, and stoves play a significant role in residential and commercial settings as they provide essential functionalities for cooking meals, heating spaces, and producing hot water. However, the energy consumption associated with these devices can be substantial if not properly managed. Inefficient burners often lead to wasted fuel …

Read More »

March 18, 2023

Common troubleshooting issues

March 16, 2023

Safety regulations

In recent years, there has been a growing concern regarding the safety of gas appliances, boilers, and stoves. The combustion process in these devices produces flue gases that contain various toxic substances such as carbon monoxide (CO) and nitrogen oxides (NOx). These harmful emissions can pose serious health risks to …

Read More »

March 3, 2023

Common troubleshooting issues

March 1, 2023

Ventilation requirements

February 8, 2023

Common troubleshooting issues

Inconsistent heat output in gas appliances, boilers, and stoves can be a frustrating issue that many homeowners encounter. Imagine coming home after a long day to cook dinner on your gas stove, only to find that the flames are not providing enough heat to properly cook your food. This scenario …

Read More »

January 25, 2023

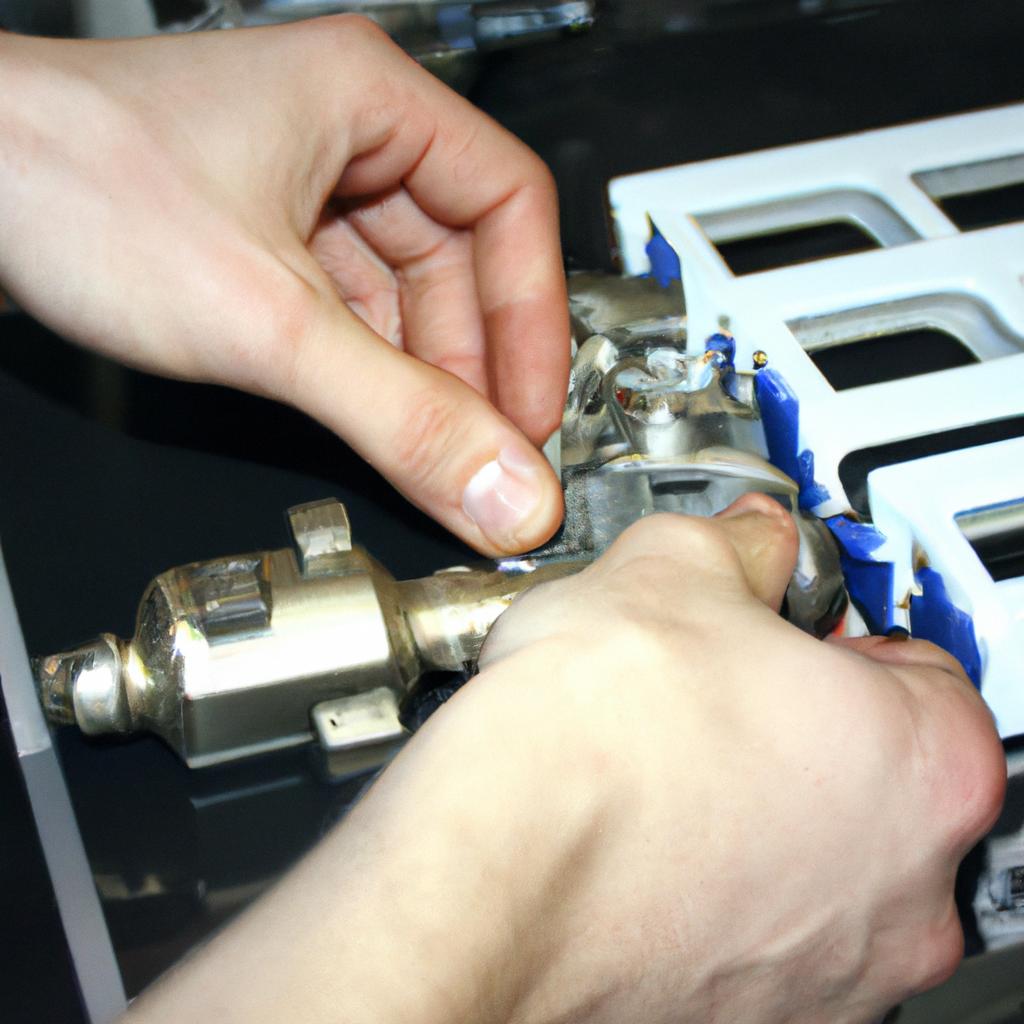

Maintenance

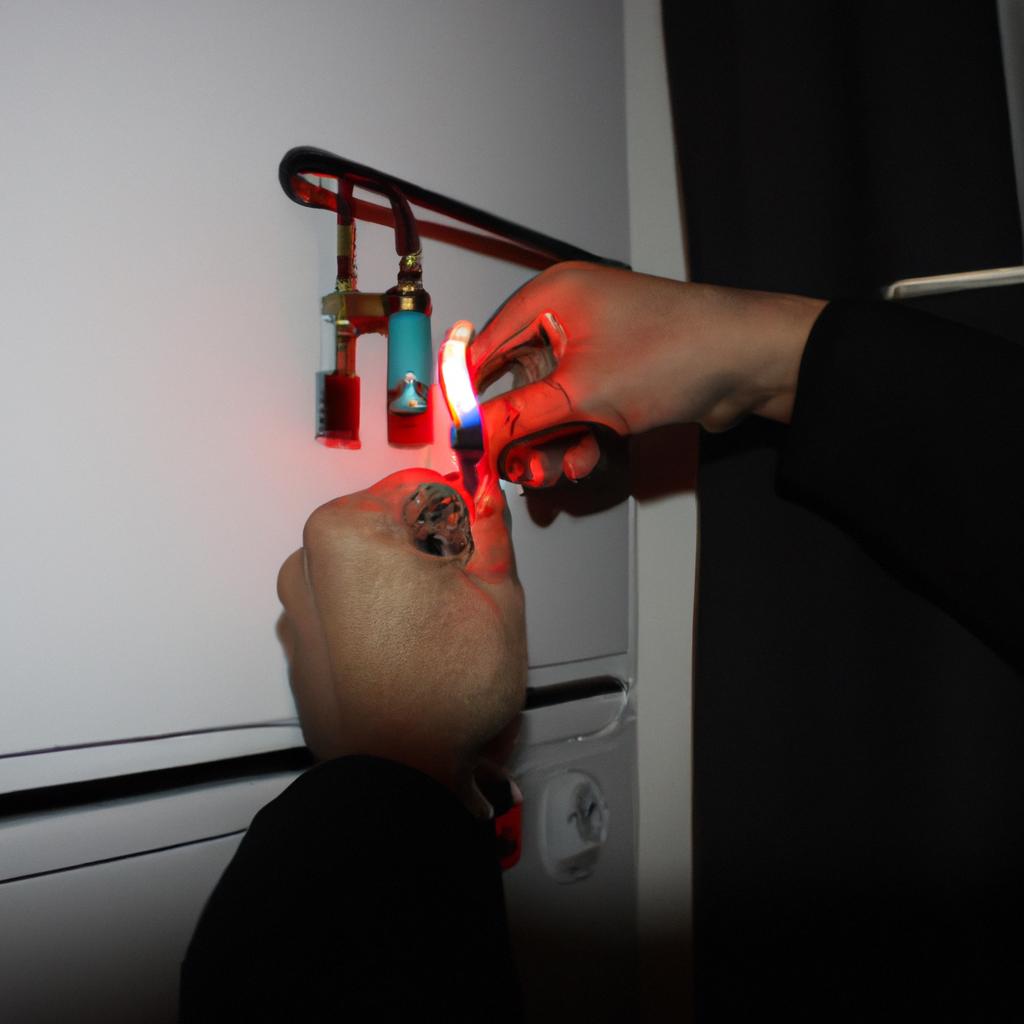

In modern households, gas appliances such as boilers and stoves play a crucial role in providing essential services. These devices rely on ignition systems to initiate combustion, ensuring efficient operation and optimal performance. However, over time, these ignition systems may experience wear and tear due to various factors like dust …

Read More »

January 14, 2023

Safety regulations

January 10, 2023

Installation guidelines

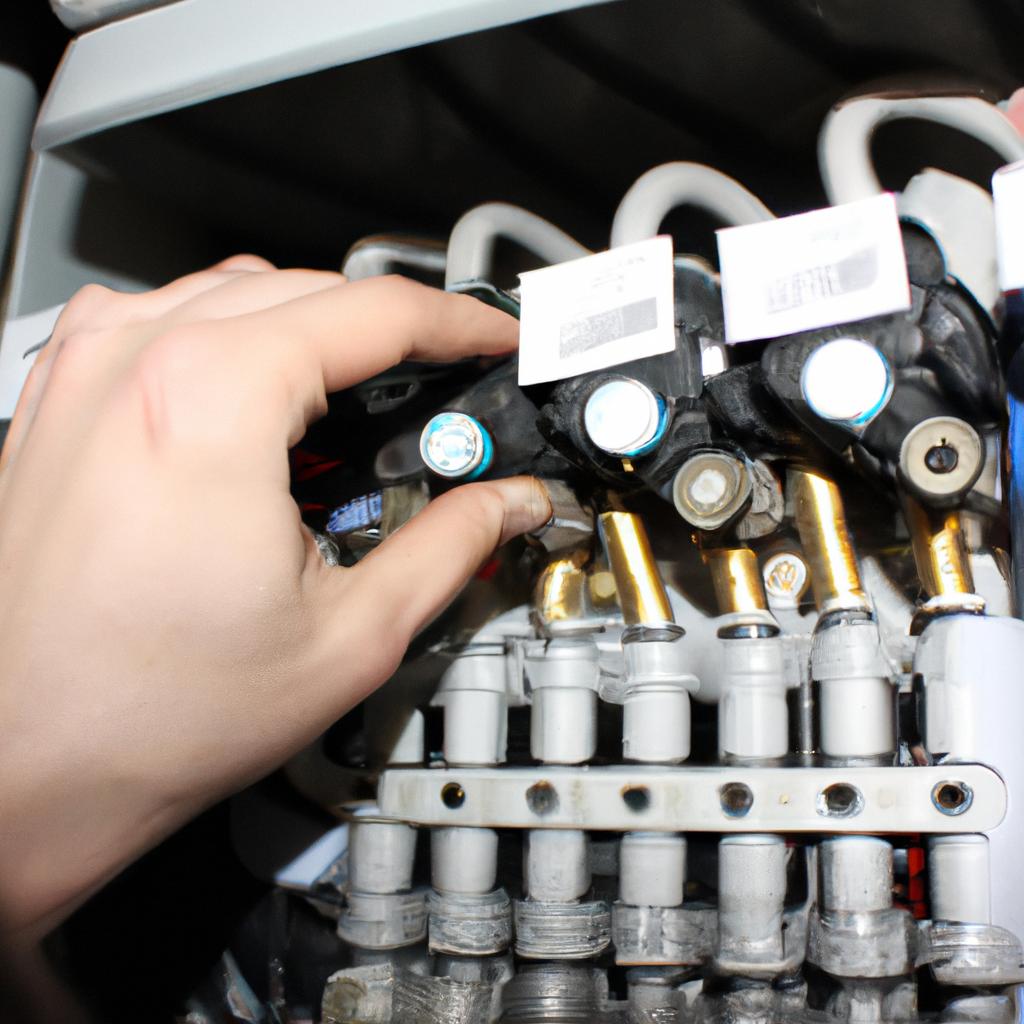

Gas appliances, boilers, and stoves play an integral role in our daily lives, providing reliable heating and cooking solutions. However, the installation of such equipment requires careful consideration to ensure safety and efficiency. This article aims to provide comprehensive guidelines for testing and inspection during the installation process, ensuring compliance …

Read More »

December 14, 2022

Energy efficiency

Energy efficiency is a crucial aspect of modern day living, particularly when it comes to gas appliances, boilers, and stoves. With the increasing concern about environmental impact and the need for sustainable practices, enhancing performance and reducing energy consumption has become paramount. For instance, imagine a scenario where a household …

Read More »

December 10, 2022

Safety regulations

December 8, 2022

Installation guidelines

November 30, 2022

Common troubleshooting issues

November 15, 2022

Maintenance

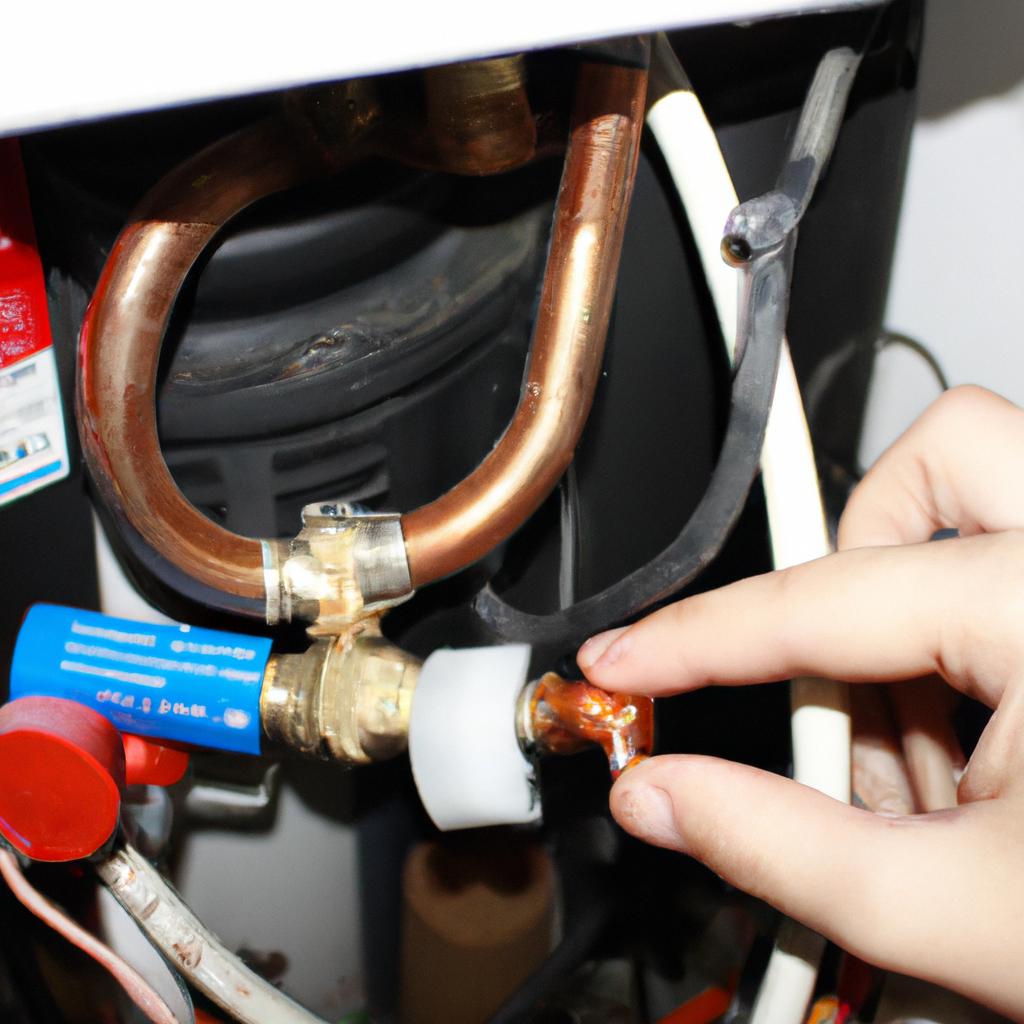

Gas appliances, boilers, and stoves play a crucial role in our everyday lives, providing us with the comfort and convenience of heating and cooking. However, without proper maintenance and regular inspections, these appliances can pose a significant risk of gas leaks. One such case occurred in a residential building where …

Read More »

November 6, 2022

Safety regulations

In recent years, concerns over safety regulations pertaining to gas appliances, boilers, and stoves have become increasingly prevalent. The potential risks associated with these household items have prompted governments and regulatory bodies to implement stringent measures aimed at ensuring the well-being of consumers. One notable case that exemplifies the importance …

Read More »

October 18, 2022

Energy efficiency

Gas appliances such as boilers and stoves play a vital role in our daily lives, providing heat for cooking and warming our homes. However, these appliances can also be significant sources of energy waste if not properly sealed. Inefficiencies due to poor sealing result in increased fuel consumption, leading to …

Read More »

October 18, 2022

Installation guidelines

October 10, 2022

Maintenance

In today’s modern homes, gas appliances such as boilers and stoves play a crucial role in providing comfort and convenience. However, like any other piece of machinery, these appliances require regular maintenance to ensure optimal performance and longevity. This article explores the importance of maintenance for gas appliances, focusing specifically …

Read More »

October 4, 2022

Energy efficiency

September 27, 2022

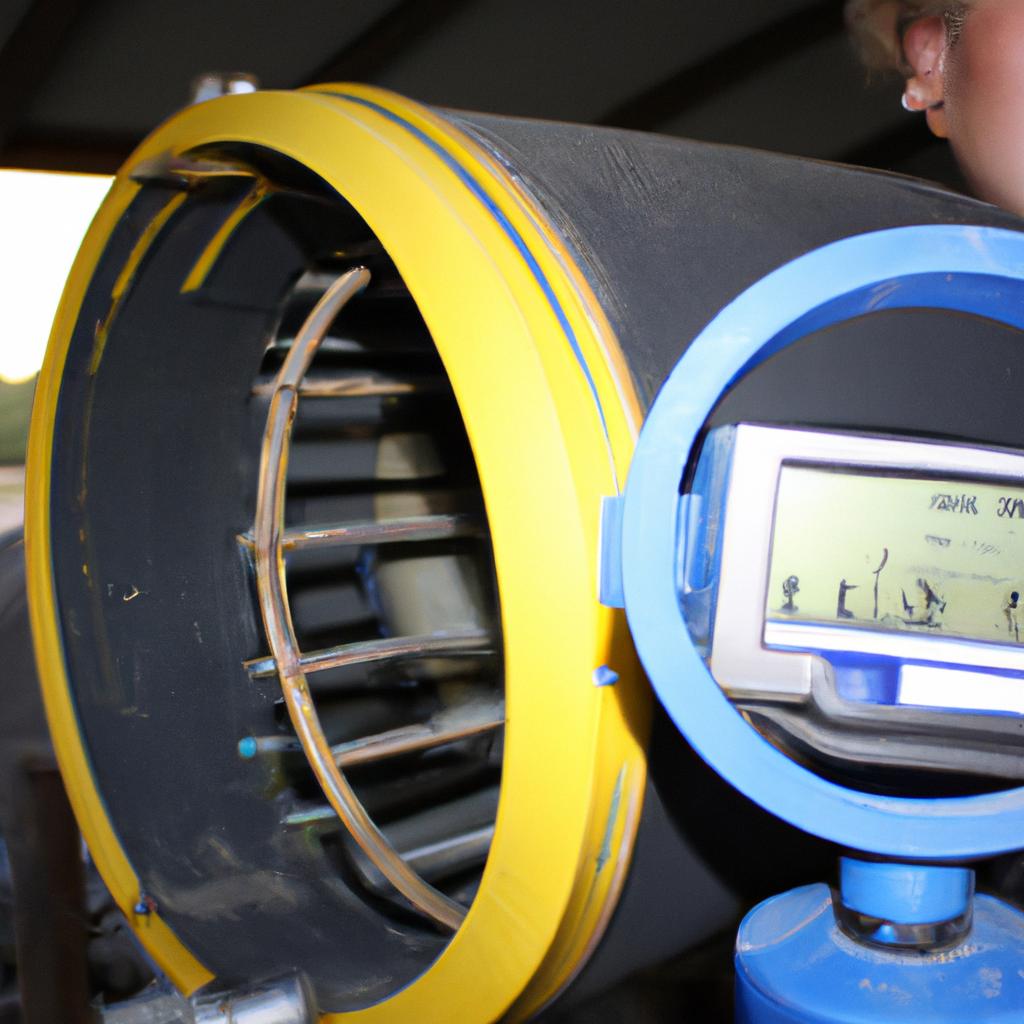

Ventilation requirements

September 20, 2022

Maintenance

Burner cleaning is a critical aspect of routine maintenance for gas appliances, boilers, and stoves. Neglecting this essential task can lead to various issues such as reduced efficiency, increased energy consumption, and even potential safety hazards. To illustrate the importance of burner cleaning, consider the case study of Mr. Johnson, …

Read More »

September 20, 2022

Ventilation requirements

September 6, 2022

Ventilation requirements

August 28, 2022

Ventilation requirements

August 9, 2022

Maintenance

Effective maintenance of gas appliances is crucial for ensuring their safe and efficient performance. One key aspect of this maintenance is the regular cleaning of flues in boilers and stoves. Flue cleaning involves removing accumulated soot, debris, and other contaminants from the exhaust system, which can significantly impact the overall …

Read More »

July 28, 2022

Installation guidelines

June 28, 2022

Common troubleshooting issues

June 28, 2022

Energy efficiency

Gas appliances, such as boilers and stoves, play a vital role in providing heat for residential and commercial spaces. However, these appliances often suffer from significant energy losses due to poor insulation. Inefficient insulation can result in substantial amounts of wasted energy and increased utility bills. For instance, consider the …

Read More »

May 1, 2022

Ventilation requirements

March 26, 2022

Common troubleshooting issues

March 24, 2022

Energy efficiency

Gas appliances play a crucial role in meeting the energy needs of households and businesses. However, their efficiency can be significantly enhanced by utilizing thermostats specifically designed for gas appliances. For instance, consider a hypothetical scenario where an office building relies on multiple gas furnaces to provide heating during winter …

Read More »

February 28, 2022

Installation guidelines

In the modern world, gas appliances such as boilers and stoves play a crucial role in meeting our daily needs for heating, cooking, and hot water. However, their installation requires careful consideration to ensure both efficiency and safety. For instance, let us consider the case of James, a homeowner who …

Read More »

January 22, 2022

Maintenance

Gas appliances such as boilers and stoves are essential for many households, providing warmth and cooking capabilities. However, a common issue that can arise with these appliances is a malfunctioning pilot light. The pilot light plays a crucial role in initiating the combustion process, ensuring the appliance operates efficiently and …

Read More »

January 13, 2022

Installation guidelines

January 6, 2022

Maintenance

Ventilation is a critical aspect of maintaining the safety and efficiency of gas appliances, boilers, and stoves. Without proper ventilation, these devices can pose serious health risks by emitting harmful gases such as carbon monoxide into indoor spaces. To ensure the optimal functioning of these appliances, regular inspection and maintenance …

Read More »

Atlanti Gaz

Atlanti Gaz